Unfair Credit Reports

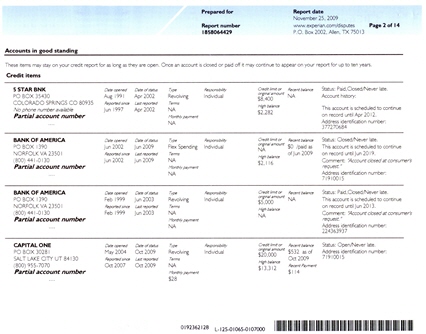

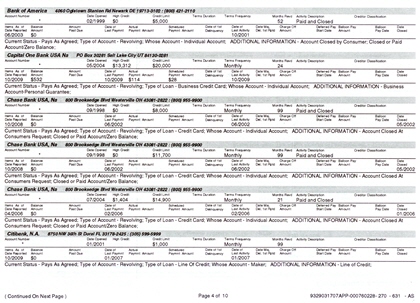

Incorrect credit reports can prevent you from obtaining a loan, cause you to pay higher interest rates, pay higher insurance premiums, and even keep your from getting a job. Fixing errors on a credit report can be a frustrating process, but it doesn’t have to be with our help. According to the Fair Credit Reporting Act (“FCRA”), creditors like CapitalOne, HSBC and Bank of America and credit bureaus (Equifax, Experian and TransUnion) have the duty to correct inaccurate information. If they don’t, you have the right to take them to court to force them to comply with the FCRA.

Although we do not offer credit repair services, we help consumers like you enforce your rights under the FCRA to make sure your credit reports are accurate. We can help you correct errors in your credit reports at no cost to you. The FCRA allows us to collect our fees and costs from the credit bureaus and creditors who reported the wrong information on your credit reports; you do not need to pay us to represent you.

Problems with credit bureaus

- Errors in your reports from Experian, TransUnion, Equifax

- Incorrect information in your credit history from Visa, MasterCard, American Express, stores, finance companies, banks, etc.

- Listing of debts that do not belong to you

- Invasion of your privacy by persons or entities who obtain your credit history without authorization

- Because of identity theft, your credit reports show debts that do not belong to you

Identity Theft

Identity theft is one of the fastest growing crimes in the United States–and police agencies don’t have the resources to fight it adequately. So, you need to take matters in your own hands. However, correcting an identity theft situation can be a cumbersome process. It is important to take steps quickly and decisively to minimize the damage to your credit history.

We can assist you in clearing-up an identity theft situation. We will collect our fees and costs, as permitted by the FCRA, from the credit bureaus and the creditors who do not correct the information in your credit reports.